Provide Absence Insurance for your clients

Our Absence Insurance can be tailored in many different ways dependent on your clients’ needs:

- Locum insurance – this is for people such as GPs, dentists etc who would need to pay a suitably qualified locum to look after their patients if they couldn’t work.

- Absence insurance – for this for locum GPs, hospital doctors (not employed by the NHS), private doctors and dental associates whose income would suffer if they couldn’t work. These clients could also consider ‘income protection’ insurance (which we don’t offer). The benefit of Absence insurance is that (depending on your client’s age) it can be cheaper and quicker to put the policy in place. The policy would pay a maximum of 75% of your client’s earnings if he or she couldn’t work – but of course, it is limited to a Benefit Period of 52 weeks.

- Overheads insurance – this is for people such as dentists, vets, opticians and people who run a practice with staff, premises etc the costs for which would continue if they couldn’t work. A typical overheads insurance policy requires the client to prove his overheads amount at the ‘claim’ stage whereas our policy simply pays the sum the client elected when he or she took out the policy.

Whether you’re advising GPs, dentists, vets, opticians or allied health professionals, your focus may well be on pensions or investment planning. However, when you are discussing financial protection with either GPs or fee-earning business owners, you’ll want to include recommendations for absence insurance: a key part of their contingency planning.

We work very closely with you to make sure your client gets the best price on the right level of cover for them. That’s because we like to provide both IFAs and their clients with the outstanding level of service for which we are renowned.

Why so many IFAs recommend Practice Cover to their clients

Around 30% of the policies placed with us come through IFAs – for good reason. When you recommend Practice Cover absence insurance you can be sure your clients get:

- a top level range of cover

- a flexible menu of benefits so that you can tailor their cover to their budget and circumstances

- keenly and sustainably priced cover.

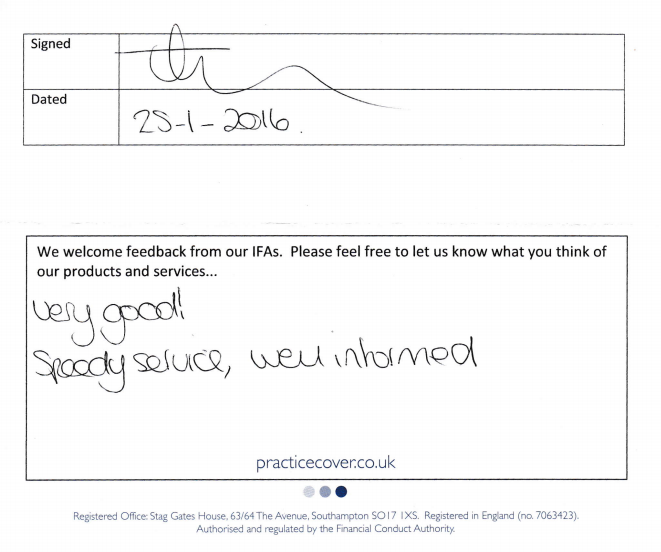

And, of course, we pay commission. We can provide testimonials from IFAs who love our service... like this:

Why IFAs like working with us

Increasing numbers of IFAs choose Practice Cover because we tailor our service to them. So when you come to us for a quote we’ll:

- discuss your client's needs with you

- help you to draw up your recommendations

- provide you with tailored quotations

- help you sort through the confusion when comparing quotes from other insurers.

Our commitment to supporting IFAs means that, whether clients come to us direct or via an IFA, the price is the same. Your clients will NOT be able to get a better price from us by coming direct.

Listen to our Podcast for IFAs

Next steps

If you know exactly what you need, just click on the appropriate link in the menu on the right of the screen, fill in the details and we will get back to you with a quotation as soon as we can.

If you’d prefer to discuss your clients’ needs with us please call us on 020 3982 0420. Or, if you email us at This email address is being protected from spambots. You need JavaScript enabled to view it. we’ll be happy to call back at a time that’s best for you.

Terms of Business

You will need a Terms of Business to place your clients' cover with us. This sets out, amongst other things, the rate of commission we pay. If you haven't yet set this up, or are unsure, just mention it when you call. We can either set the wheels in motion or let you know that an appropriate agency is already in force.