Many GP practices are paying for locum insurance based on outdated NHS reimbursement rates, simply because no one has told them the rates have changed at renewal. That matters more than most practices realise. If your policy hasn’t been reviewed recently, you could be…

News

Seasonal Increase Cover for Refrigerated Stock

Stay Fully Protected During Your Busiest Months As the year draws to a close, many surgeries see a surge in patient activity and with it, a rise in temperature-sensitive medical supplies. Vaccine stock levels often peak between September and December. To help you stay…

Practice Cover Joins the BDIA

The Association for the UK Dental Industry We’re pleased to share that Practice Cover is now a member of the British Dental Industry Association (BDIA). It’s a straightforward move with a simple purpose, to understand the dentistry sector better and support it more…

When Injury Strikes Away from Work

A holiday over Christmas took an unexpected turn for one of our insured GPs after a swimming accident abroad resulted in a neck injury and ongoing nerve pain. The injury wasn’t permanent, but symptoms such as numbness and pins and needles meant a slow recovery that…

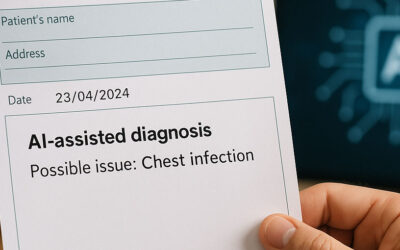

AI in GP Surgeries – Innovation Meets Liability

Artificial intelligence (AI) is rapidly transforming UK primary care. According to NHS England, more than 80 NHS trusts are already piloting or deploying AI tools to analyse imaging, flag abnormal test results, and assist in triage or diagnosis. The government’s £21…

The Countdown Is On

Meet Practice Cover at The Best Practice Show 2025! The wait is nearly over, The Best Practice Show is almost here! We’re thrilled to announce that Practice Cover will be at Stand K25 at the Birmingham NEC on 8-9 October, ready to connect with healthcare professionals…

Terrorism Insurance

In recent years organisations which would not, previously, have considered the need for insurance against terrorism are now thinking very carefully about whether they could be a target or whether they could be caught up in an attack in their neighbourhood….

Loyalty penalty – don’t get caught!

There is nothing like a juicy headline to stir up irritation and make you worry that you’re being fleeced. Citizen’s Advice, Money Expert, the Associate of British Insurers, they’re all concerned – quite rightly, in my view – that people who buy insurance get a better…

Is your renewal transparent?

I’ve just had a nice surprise: a cheque that I wasn’t expecting. It came from an insurer and their letter explained that they were compensating me for their failure to follow FCA rules. I thought I’d share the rationale with you. You…

ROLL UP! ROLL UP! Cheap locum insurance

Whatever you’re buying for your practice, whether it’s a phone system, vaccines or locum insurance, you’d be right to shop around. No-one likes to think they are paying over the odds – particularly for something like insurance which, with any luck, you’ll just put in…

Jury service is no longer an option. Are you prepared?

A summons for jury service can create a frisson of excitement or a feeling of dread, depending on your view of the criminal justice system and the extent to which you want to be involved. For your practice it can be tricky, both logistically and financially, to plan…

Protecting your dental practice against unexpected absence

When you have spent years building up a successful practice, you need an assurance that it won’t crumble if you’re off sick. Our Absence Insurance pays a weekly sum for up to 52 weeks to meet the fixed costs that will continue pouring in regardless. We don’t need to…